Conveyancing, the legal side of a property sale, is adapting to new trends.

Trends such as electronic conveyancing settlements, auction contracts, personal guarantees for company purchasers, subject to finance, tree problems and tax clearances.

This is a summary of these six trends:

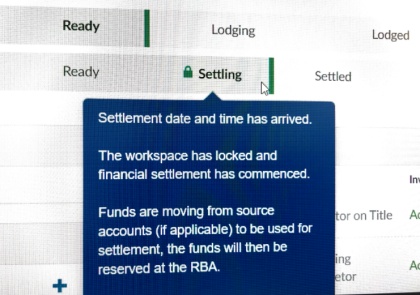

- Electronic Conveyancing Settlements - settlements are the business end of a property sale when the title is transferred in exchange for payment of the price. E conveyancing has replaced the paper based settlement process of bank cheques, titles and transfers. It's all now done on a computer screen.

- Auction Contracts - Purchasers often request, and vendors often agree to two changes to the contract - (1) a 5% deposit instead of 10% and (2) a longer settlement period than 42 days, to give time to sell their current property.

- Personal Guarantees - the directors of a company are now expected to provide their personal guarantee when they buy in the name of their company.

- Subject to Finance - In Queensland and Victoria, contracts often contain a subject to finance

clause. But not in NSW - unconditional contracts are the norm.

- Tree Problems - Don't assume you can remove a tree easily from a property you are buying.

- Tax Clearances - If a property is sold for $750,000 or more, the vendor must obtain an ATO Tax Clearance, otherwise the purchaser must pay 10% of the price to the ATO.

For more details click on my article