Your business is failing. The unpaid invoices are piling up.

Should you have one last throw of the dice, and make one last order from a supplier without having the money to pay, hoping to sell the items for a profit and keep the business afloat?

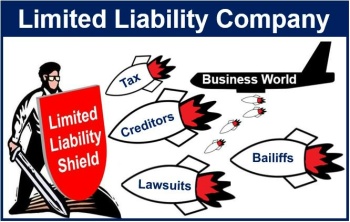

It's tempting ... particularly if you operate your business through a company, which is a separate legal entity which shields its directors from personal liability by limiting liability to the assets of the company.

But how effective is the shield of limited liability?

The Corporations Act removes the shield of limited liability when a company director incurs debts if their company is unable to pay its debts as they fall due - what the Act calls 'insolvency'. A liquidator is able to recover those debts from the company director personally.

In a recent decision of the NSW Supreme Court, the directors of a company were ordered to personally pay $115,000 to the liquidator of their company to pay for debts incurred.

The liquidator's task of proving that the company was insolvent was made easy by the fact that the directors did not produce company financial records, and so the liquidator was entitled to the presumption of insolvency extending back for a period of 7 years.

If your business is failing, don't keep trading. And get some professional advice on going into administration or liquidation to avoid becoming personally exposed to debts.