Why two heads are better than one for property ventures

Everyone is different. No one is good at everything.

Some people know how to spot a property bargain. Others know how to add value to a property.

Some people know how to find finance to buy property. Others know how to sell a property for top dollar.

If two people combine their knowledge and their money in a property venture, they will often achieve more as partners than they would achieve on their own.

These two people are joint venture partners in a property joint venture.

Partnering for Property Investment and Real Estate Development

Partnering is used in the business world. Franchising is a popular form of partnering - the franchise company contributes their franchise systems, and the franchisee contributes their money and runs the business. Together they build the franchised business.

Partnering is used in property investment and real estate development. Here are some scenarios –

Joint Ventures for Property Investment

- Two real estate investors decide to buy a property to rent out. They contribute one half each of the deposit and purchase expenses, and jointly borrow the finance to fund the balance purchase price. They share the rents and contribute to loan payments equally. Their names will appear on the title to the property. This is an ‘all money’ joint venture, good for passive property investments.

- Two real estate investors decide to buy a property to renovate and sell. One is a better price negotiator and the other is a better renovator. They contribute their money equally and agree that their ‘skills’ contributions are equal. They share the profits equally. There are many variations – sometimes an equity partner will pay the deposit and buying costs, and a finance partner will take out the loan. If the ‘money partner’ agrees that the ‘skills partner’ is ‘paid’ for their ‘skills’ contribution by way of profit share, instead of money, then it is a ‘mixed money and skills’ joint venture. This is good for active property investments and for vendor finance joint ventures.

Joint Ventures for Real Estate Development

- Two real estate investors decide to buy a property to build a garden flat in the backyard, subdivide and sell. They obtain building and subdivision approvals, project manage the building and sell the existing house at the front and the new garden flat at the rear. After paying the project expenses, they share the profits. Their next project might be a land subdivision or to strata a building.

- A property owner (or a property investor) decides to partner with a property developer or builder for a real estate development. The property owner contributes the development site; the property investor contributes the money to buy the development site. The property developer contributes their skill in obtaining council approvals, engaging architects, town planners, project managers, and selling agents. They engage a builder to build the villas or home units. After the contributions are reimbursed, the joint venturers share the profits.

In each scenario, what the joint venturers decide to do with the property, their contributions, and how the profits are to be shared, should be agreed in writing to avoid disputes later.

What must a Property Joint Venture Agreement contain?

A Property Joint Venture Agreement needs to be in writing, to make sure that it holds up in court. As Justice Michael Kirby has said –

... A joint venture is a particular and increasingly familiar form of relationship between business parties, corporations or individuals … the main features of [joint ventures] are typically defined in a written agreement [where] the parties … contemplate a harmonious and cooperative relationship of mutual advantage.

The property joint venture agreement should contain details of –

- The joint venture project

- The names of the two, three or more people who are to be the joint venturers

- The property

- The contributions - money or skills or both

- A budget, if renovation or development is envisaged

- The responsibilities of each joint venturer

- The profit sharing formula

- The expenses to be paid out of joint venture funds

- The ways the joint venture can be terminated, including a timeframe

- An exclusion from being a partnership, principal and agency, or fiduciary relationship

- A dispute resolution process

- A place at the end to sign

We prepare different joint venture agreements to suit property investment and real estate development joint ventures because the way the joint venture will work is different in each case.

Two forms of joint venture agreements are prepared. The first is a short form, which is known as a Heads of Agreement. The Heads of Agreement is suitable for simple property joint ventures. The second is a long form, a formal Joint Venture Agreement. Both are legally valid when they are signed.

Every property joint venture should have a separate joint venture agreement.

The contributions and profits in a Property Joint Venture

The joint venturers make initial contributions of money and skills. These contributions will continue during the joint venture. The joint venturers receive profits from a successful joint venture at the end.

The initial contributions

The funds to buy an investment property are contributed by the joint venturers. They fund the deposit of 10% or 20% of the price and borrow the balance of the funds to pay the price from the bank. The stamp duty, conveyancing fees and loan expenses will add up to 5% extra, which will need to be funded up front.

The skills contributions are often equal. If any special skills contribution to be recognised, such as to renovate a property, or selling using vendor finance, it should be agreed before the joint venture starts.

The ongoing contributions and ongoing profit share

Active management of an investment property will require funds to pay for maintenance & repairs, council & water rates, strata levies, land tax and insurance. Property management skills will be required to manage the tenants. If the property is negatively geared, the joint venturers will need to make regular financial contributions. If the property is positively geared, they will receive regular profit distributions.

Active management of a real estate development project will require funds to pay for the approvals, and for the building work. Skills will be required to project manage the approval process, the building work and the drawdowns of the construction finance. Shortfalls between funds available and outlays required will need to be contributed by the joint venturers.

The final profit share

At the end of the joint venture project, the proceeds are distributed to the joint venturers.

The proceeds of sale of the property are applied as follows –

- To repay the finance – bank loan or construction loan

- To pay the sale expenses – the agent’s commission, advertising, conveyancing fees

- To pay joint venture expenses which remain unpaid

- To distribute the net proceeds to the joint venturers – this is the final profit share

Legal structures for Property Joint Ventures

In simple property joint ventures, the property will be owned in the personal names of the real estate investors. This simplicity gives the real estate investors borrowing capacity based on personal income, access to ongoing losses, and involves no set-up or ongoing costs for an investment structure. No ABN registration is needed unless it is an ‘enterprise’. The downsides are: no asset protection, inefficient tax planning and a limit to the number of properties because of borrowing capacity limits.

In sophisticated joint ventures, the real estate investors invest via their family trust or self-managed super fund (SMSF). This gives the investors asset protection and tax planning advantages. The trustee of the family trust or self-managed super fund (SMSF) will usually be a company. The trustee company will become the joint venture partner as trustee for the trust.

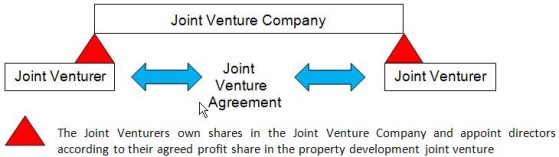

In sophisticated property joint ventures, another company is set up to own the property, which sits above the joint venture partners. This joint venture company shields the joint venturers from legal liability and financial risks in the joint venture. This structure is called an incorporated joint venture. The relationship between the joint venturers will be set out in a joint venture agreement.

Illustration of a legal structure for a property development joint venture

The Joint Venture Company will have one of these roles -

- The Joint Venture Company stands alone if so, the company will be the property holding company and the business entity. The company will have an ABN as an Australian Private Company and submit a company tax return. Company tax is paid on the profits. The profits are distributed as franked dividends to the joint venturers through their shareholdings.

- The Joint Venture Company is the trustee of a unit trust if so, the company will be the property holding company and the unit trust the business entity. The unit trust will have an ABN as a Fixed Unit Trust and submit a trust tax return. No tax is paid by the trust on the profits. The unit trust will distribute profits to the joint venturers through their unit holdings.

- The Joint Venture Company is the trustee of a custody trust if so, the company will be the property holding company and the joint venture the business entity. The custody trust (also known as a bare trust) is not a business entity. The joint venture will have an ABN as an Other Partnership (no ABN category exists for joint ventures) and submit a partnership tax return. The joint venturers will share the profits and the losses in the same way as partners share profits and losses.

The only business activity of the Joint Venture Company will be the property development.

The Investor’s Guide to Property Ventures has been produced by Cordato Partners Lawyers, as part of its Property Law practice. We can meet all your conveyancing needs.

To join the free mailing list for the Guide (mail or email), Contact us below: